Arizona

Know Before You Owe

Know Before You Owe

Disclosures for Arizona Title Loans (Secondary Motor Vehicle Finance Transactions)

- Who is the Creditor?

- FALFITA Capital LLC, dba AZ Easy Credit

- FALFITA Capital LLC, dba AZ Easy Credit

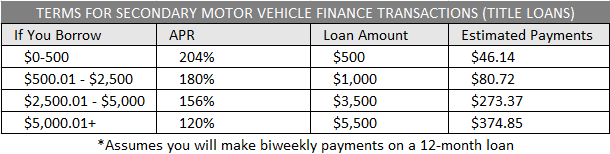

- Annual Percentage Rate (APR)

- Your Annual Percentage Rate (APR) will vary depending upon how much you borrow.

- Your Annual Percentage Rate (APR) will vary depending upon how much you borrow.

- Important Notice

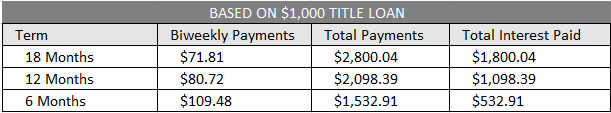

- A secondary Motor Vehicle Finance Transaction (Title Loan) is an expensive form of credit. If you make larger payments, you will have to pay less interest and the sooner you will pay off your loan.

- A secondary Motor Vehicle Finance Transaction (Title Loan) is an expensive form of credit. If you make larger payments, you will have to pay less interest and the sooner you will pay off your loan.

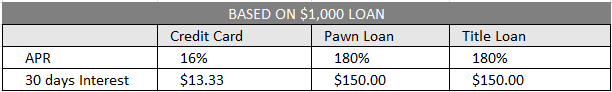

- Cost Comparison Chart

- Larger Payments = Less Interest

- WARNING: If you refinance your loan, you will pay more interest

- Fees

- Document Preparation Fee: $0

- Late Fee: If payment is 10 days late, 5% of the unpaid balance of the late payment

- Prepayment Penalty: The is no fee or penalty to pay off your loan early

- Important Notice: If you default, you could lose your vehicle!

- All of the loans that we provide in Arizona are vehicle title loans. If you miss a payment and default on your loan agreement, it it possible that your vehicle could be repossessed and/or a lawsuit could be brought against you.

- All of the loans that we provide in Arizona are vehicle title loans. If you miss a payment and default on your loan agreement, it it possible that your vehicle could be repossessed and/or a lawsuit could be brought against you.

- Questions to Ask Yourself

- Is it necessary for me to borrow the money?

- Can I afford to pay this loan back in full by the due date?

- Will I be able to pay my regular bills and repay this loan?

- Can I afford the extra charges, interest, and fees that may be applied if I miss or fail to make a payment?

- Are other credit options available to me at this time?

Contact Information for Consumer Counseling

Please see the following link to the U.S. Department of Justice website for a list of federally approved credit counseling agencies:

http://www.justice.gov/ust/eo/bapcpa/ccde/cc_approved.htm

Spanish Translation

A Spanish translation of this entire document is available upon request.

Una traducción en Englés de este acuerdo está disponible bajo petición.

– Additional Loan Details –

Minimum first time loan – $100

- Maximum first time loan – $1000

- Maximum Loan – $5000

– Loan Terms range from 7-24 months with no prepayment penalty**

– Annual Percentage Rate is approximately 120-204%**

** Actual Loan Terms, Fees, Interest and other loan terms vary based on applicants qualification

What can i use the money for?

Sample loans

Vacations

Car Repairs

Unexpected Expenses

Pet Care

Home Improvements

Technology

Medical Bills